All Categories

Featured

Table of Contents

Any type of warranties provided are backed by the economic strength of the insurance firm, not an outside entity. Capitalists are cautioned to very carefully assess an indexed annuity for its features, costs, risks, and just how the variables are computed. A set annuity is meant for retired life or other long-lasting demands. It is meant for an individual who has adequate money or various other liquid properties for living costs and various other unanticipated emergencies, such as clinical costs.

:max_bytes(150000):strip_icc()/VariableAnnuitization-asp-v1-5dedf8fee4694d8dacd2ac7eb7b0757e.jpg)

Please think about the investment goals, risks, fees, and costs meticulously prior to investing in Variable Annuities. The program, which contains this and other info about the variable annuity agreement and the underlying financial investment options, can be acquired from the insurer or your economic professional. Make certain to review the syllabus very carefully prior to determining whether to spend.

Variable annuity sub-accounts vary with adjustments in market problems. The principal may be worth much more or much less than the original quantity spent when the annuity is given up.

Attempting to choose whether an annuity could fit right into your financial strategy? Understanding the various offered annuity choices can be a helpful way to start. The terms surrounding these long-lasting investments might be confusing at. Financial professionals can help you understand every little thing, yet here's a fundamental introduction of the readily available annuity alternatives and their timelines to assist you get begun.

For the initial or ongoing exceptional settlement, the insurance provider dedicates to specific terms concurred upon in the agreement. The most basic of these contracts is the insurance company's commitment to giving you with repayments, which can be structured on a month-to-month, quarterly, semi-annual or annual basis. You might select to forego repayments and permit the annuity to expand tax-deferred, or leave a swelling sum to a recipient.

There additionally could be optional functions (bikers) offered to you, such as an enhanced death benefit or lasting care. These provisions generally have added costs and prices. Depending on when they pay out, annuities fall under two main categories: prompt and delayed. Immediate annuities can use you a stream of earnings right now.

Decoding How Investment Plans Work Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Choosing Between Fixed Annuity And Variable Annuity Is a Smart Choice How to Compare Different Investment Plans: Explained in Detail Key Differences Between Variable Vs Fixed Annuities Understanding the Key Features of Long-Term Investments Who Should Consider Variable Vs Fixed Annuity? Tips for Choosing Fixed Income Annuity Vs Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Fixed Interest Annuity Vs Variable Investment Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

When you can manage to wait for a while to receive your payment, a deferred annuity may be a great selection for you. Immediate annuities can offer a routine stream of assured settlements that can be structured for the remainder of your life. They might also refund any remaining settlements that have not been made in case of early fatality.

With prompt annuities, there are various kinds of settlement alternatives. As an example, a life payout supplies a settlement for your life time (and for your spouse's lifetime, if the insurer uses a product with this alternative). Duration certain annuities are equally as their name implies a payout for a collection amount of years (e.g., 10 or twenty years).

In addition, there's in some cases a reimbursement choice, a feature that will pay your beneficiaries any type of leftover that hasn't been paid from the first premium. Immediate annuities typically use the highest settlements contrasted to other annuities and can assist attend to an immediate income need. There's constantly the chance they may not maintain up with rising cost of living, or that the annuity's beneficiary might not get the staying balance if the owner chooses the life payout choice and after that passes away prematurely.

Breaking Down Your Investment Choices A Closer Look at Indexed Annuity Vs Fixed Annuity Defining Fixed Vs Variable Annuities Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Is Worth Considering Deferred Annuity Vs Variable Annuity: How It Works Key Differences Between Different Financial Strategies Understanding the Risks of Immediate Fixed Annuity Vs Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Fixed Interest Annuity Vs Variable Investment Annuity Financial Planning Simplified: Understanding Fixed Vs Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

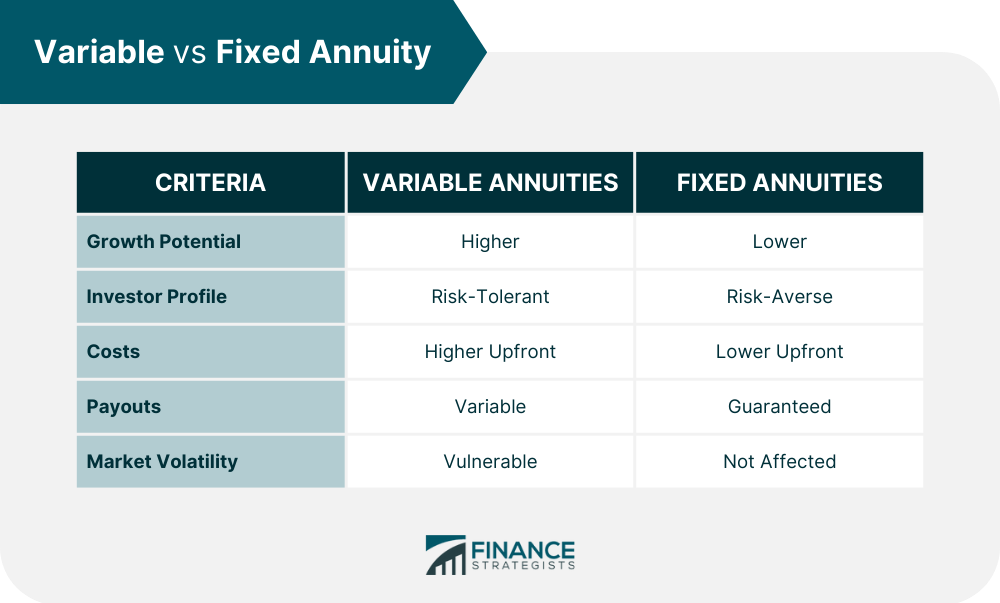

Taken care of, variable and fixed indexed annuities all accumulate interest in different methods. All three of these annuity kinds normally offer withdrawals, methodical withdrawals and/or can be established up with a guaranteed stream of earnings. Perhaps the most convenient to recognize, dealt with annuities assist you expand your money since they provide a set rate of interest (guaranteed rate of return) over a collection period of years.

Interest gained is intensified and can be left in the annuity to continue to expand or can be taken out after the contract is annuitized (or potentially during the agreement, depending on the insurance coverage firm). The interest prices supplied may not keep up with rising cost of living, and you are devoted to them for the collection period no matter of financial variations.

Relying on the efficiency of the annuity's subaccount options, you may receive a higher payout as a result of that market exposure; that's due to the fact that you're additionally running the risk of the added equilibrium, so there's also a possibility of loss. With a variable annuity, you obtain every one of the interest attributed from the invested subaccount.

And also, they might also pay a minimum guaranteed passion price, no matter of what takes place in the index. Payments for fixed indexed annuities can be structured as assured routine repayments just like other type of annuities, and passion depends on the regards to your agreement and the index to which the cash is connected.

Just repaired indexed annuities have a sweep date, which notes the day when you first begin to take part in the index allotment's efficiency. The sweep day varies by insurance company, however usually insurance companies will assign the funds between one and 22 days after the initial investment. With repaired indexed annuities, the attributing period begins on the move day and generally lasts from one to 3 years, depending on what you pick.

For more youthful individuals, an advantage of annuities is that they offer a means to begin preparing for retirement early on. With an understanding of exactly how annuities function, you'll be much better geared up to choose the best annuity for your demands and you'll have a far better understanding of what you can likely anticipate along the road.

Understanding Financial Strategies A Comprehensive Guide to Investment Choices Defining Deferred Annuity Vs Variable Annuity Features of Smart Investment Choices Why Choosing the Right Financial Strategy Can Impact Your Future Fixed Index Annuity Vs Variable Annuities: Simplified Key Differences Between Different Financial Strategies Understanding the Rewards of Variable Vs Fixed Annuity Who Should Consider Fixed Annuity Vs Equity-linked Variable Annuity? Tips for Choosing Fixed Vs Variable Annuity Pros Cons FAQs About Annuities Variable Vs Fixed Common Mistakes to Avoid When Choosing Choosing Between Fixed Annuity And Variable Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Variable Vs Fixed Annuities A Closer Look at How to Build a Retirement Plan

A set annuity is a tax-advantaged retirement savings option that can help to assist construct predictable possessions while you're working. After that, after you determine to retire, it can create a guaranteed stream of revenue that could last for the remainder of your life. If those benefits attract you, keep reading to locate out even more regarding: How set annuities workBenefits and drawbacksHow fixed annuities compare to various other kinds of annuities A set annuity is a contract with an insurer that is comparable in numerous ways to a financial institution deposit slip.

Commonly, the rate of return is assured for multiple years, such as five years. After the first guaranteed period, the insurance provider will reset the rate of interest rate at normal periods usually yearly but the new rate can not be lower than the guaranteed minimum passion price in the agreement.

You don't necessarily need to transform a repaired annuity into routine revenue settlements in retirement. You can pick not to annuitize and receive the entire worth of the annuity in one lump-sum settlement. Taken care of annuity contracts and terms vary by carrier, but other payout choices typically include: Period particular: You receive routine (e.g., monthly or quarterly) assured settlements for a fixed period of time, such as 10 or twenty years.

This may give a tax advantage, especially if you begin to make withdrawals when you remain in a reduced tax obligation brace. Intensified growth: All interest that remains in the annuity additionally earns interest. This is called "compound" rate of interest. This development can proceed for as long as you hold your annuity (topic to age limits). Guaranteed income: After the first year, you can convert the quantity in the annuity into an ensured stream of set revenue for a specified amount of time and even for the rest of your life if you select.

Latest Posts

Pacific Life 5 Year Annuity

Legacy Annuities

National Life Group Annuities